我的2019 financial accounting学习计划。

MATERIAL: Financial Accounting: Introduction level by UPenn, Coursera, Professor Brian Bouche

Charpter 1

overview

Accounting is a system for recording information about business transactionsnot everything a business does gets recorded in the financial statements, and sometimes it’ll seem like nothing’s happening, yet we’ll need to record a transaction anyway.) to provide summary statements of a company’s financial position and performance to users who require such information.(different user groups would want different summary numbers.)

three sets of books

Financial accounting: geared toward external users like investors, creditors, customers, suppliers, competitors and any other stakeholder or person that has interest in the company.

Tax accounting: based upon tax rules that are used to compute how much taxes a company has to pay.

managerial accounting: This provides customized reports for internal decision making

financial reporting requirements, by SEC

10-K: annual report

10-Q: quarterly report

8-K: current report; If anything material happens between quarter ends, Material information is generally viewed as anything important enough to move stock price, which means companies file these quite often.Example: They don’t require the financial statements, just an update of whatever major corporate event has happened, something like a top manager resigns or you lose a big customer or there’s a lawsuit or something along those lines.

Be prepared in accordance with generally accepted accounting principles, or GAAP.

Who establish GAAP?

-US Congress, but they delegate to:

-The SEC, but they delegate to:

-FASB, financial Accounting Standards Board:

sometimes they’re even too busy to make all the rules, and so there’s an emerging issues task force(EITF) and the AICPA that can also have a hand in making accounting rules, or US GAAP.

US GAAP is still required for US firms.

For the world

IFRS, that are established by the International Accounting Standards Board, or IASB.

Who is responsible for financial reporting?

1 Management is responsible to prepare. So they may manipulate.(be cautious of opportunistic behavior)

audit committees of the board of directors provides oversight of management’s process

auditors are hired by the board to express an opinion about whether the statements are prepared in accord, accordance with GAAP.

2 SEC and other regulators take actions against the firm if any violations of GAAP or other rules are found

3 information intermediaries like stock analysts, institutional investors and the media provide the biggest check on managers’ behavior by either exposing or fleeing firms with questionable accounting.(But by the time one of these parties get involved, it’s a very public issue, the stock price drops and you’re in bad shape if you’re an investor or employee of the company)

required financial statements

Balance sheet: company’s financial position, which is its listing of all its resources and obligations on a specific date. On a specific date

Income statement: the results of operations over a period of time (between two balance sheet, a quater or a yeay) using accrual accounting(based on buiness activities not on cash flows).

Statement of Cash Flows:sources and uses of cash over a period of time.

Statement of Stock holders’ equity:

examples

CF statement

segerated into three parts:

1 operating CF, transactions related to providing goods or services or other normal business activities.

2 investing CF, which are transactions related to the acquisition or disposal of long-lived assets.

3 fianancing CF, which are transactions related to owners or creditors.

Income Statement, accounting income

using accural accounting

Revenues: increases in owners’ equity from providing goods or services

Expenses: decrease in owners’ equity incurred in the process of generating revenues

Bottom line: Net income(or Earnings or net profit)= Rev-Expense; doesn’t equal changes in cash

Balance sheet

Assets: which are resources owned by the business, that are expected to provide future economic benefits.

Cash

Accounts Receivable

Prepaid rent(All money paid on rent - actual rent paid for this month)

Things like Truck(Money spent on it - depreciation)

Liabilities and Stock holders’ Equity:

Liabilities: claims on those assets by creditors, or non owners. Creditors, that represent an obligation to make future payments of cash, goods, or services.

Stockholder’s equity : claims on the assets by the owners of the business. (Two sources, 1 contributed capotal arises from sale of shares; 2 retained earnings(arises from operations)

Like:

Bank debt

Common Stock

Retained earnings(Accounting net income - dividends)

Statement of stockholders equity

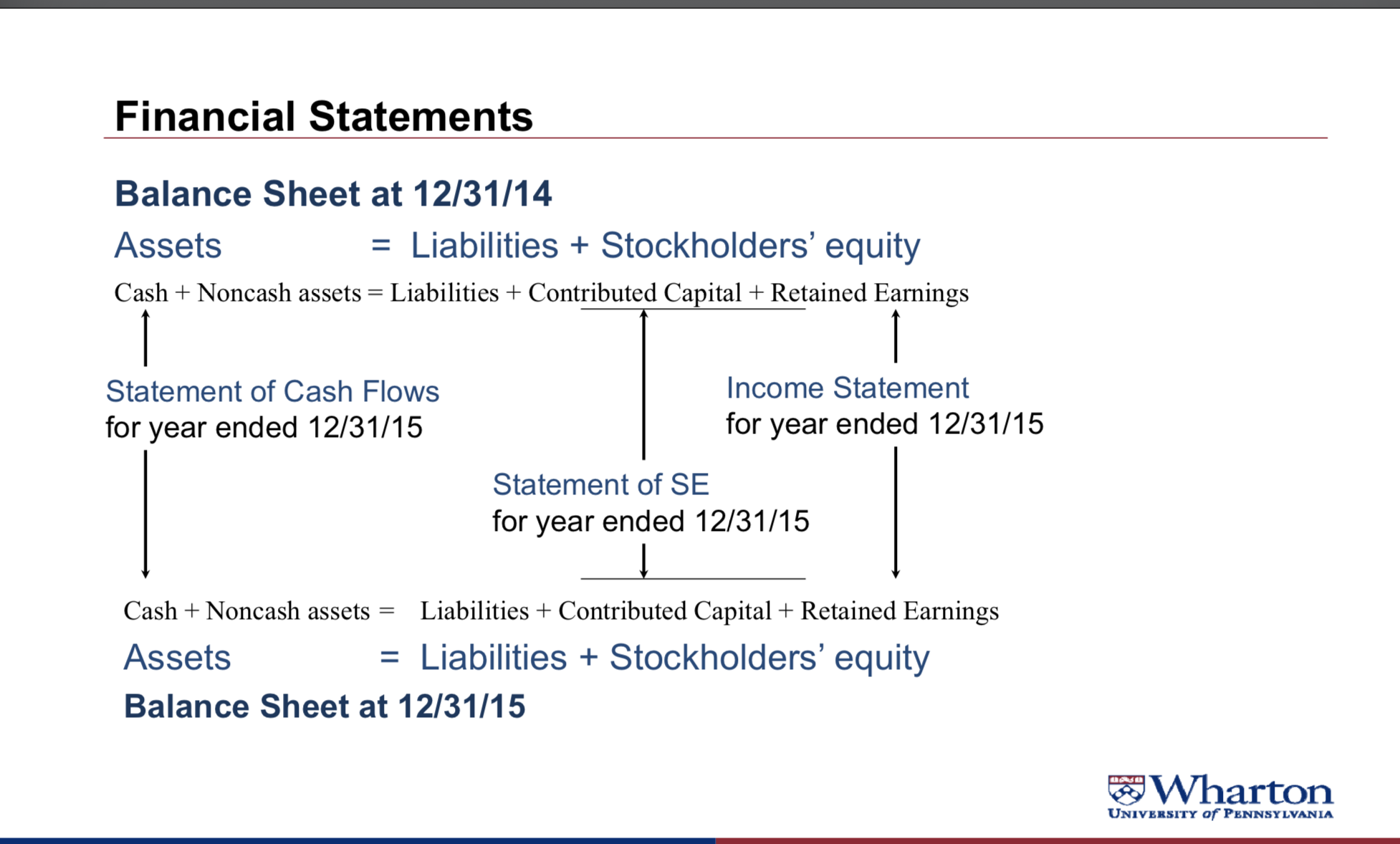

Balance sheet equation; A, L and shareholders’E

Balance sheet equation

Equation: A=L+E(Resources = claims on resources by outsiders+owners)

or:

CASH+NON-CASH ASSETS = Liabilities +Contributed Capital+Retained Earnings

Changes between two Balance Sheets are going to be summarized in the Income Statement, the Statement of Stockholders’ Equity, and the Statement of Cash Flows.

Shareholders Equity= Contributed capital(money raised from shareholders) + Retained Earnings(create by operating the business)

Retained earnings = prior retained earnings +Net income - Dividends

Long version of A=L+E:

Assets = Liabilities +Contributed Capital+prior retained earnings +Rev-Expenses - Dividends

A L and E

Asset

An asset is a resource that is expected to provide future economic benefits. That means, it’s either going to generate future cash inflows or it’s going to reduce future cash outflows.

rules of recognition:

1 acquired in a past transcation or exchange

2 the value of its future benefits can be measured with a reasonable degree of precision.

Example:

1 BOC sells \$100,00 of merchandise to a customer that promises to pay cash within 60 days. Yes, Accounts Receivable. Aleady deliver goods, past transaction.

2 BOC signs a contract to deliver \$100,000 of natural gas to DEF, each month for the next year. Not an asset because no past transactions. All we do is signing a contract and the contract may broke.

3 B.O.C. buys $100,000 of chemicals to be used as raw materials. B.O.C. pays in cash at the time of delivery and receives a 2% discount on the purchase price. Yes, inventory. Inventory is a term that we are going to use for any product or raw materials that we buy, that we’re going to turn into a finished product that we’re going to sell at a markup.

4 BOC pays 12 million for the annual rent on its office building. It has already occupied it for one month.

Yes, prepaid rent, \$11 million

5 BOC is advised by a marketing firm that its brand name is worth $63 million. Not an asset. because we never acquired it in a past transaction or exchange, and you can argue that the value of the brand cannot be measured with a reasonable degree of precision.

Liabilities

Definition: A liability is a claim on assets by creditors or non-owners, that represent an obligation to make future payment of cash, goods, or services.

Rules of recognition:

1 the obligation is based on benefits or services received currently or in the past

2 the amount and timing of payment is reasonably certain.

Examples:

1 BOC receives $300,000 of raw materials from a supplier and promises to pay within 60 days. Yes, Accounts Receivable

2 BOC estimates that it owes the IRS $3 million in taxes. Yes, Income Tax Payable. As long as we are reasonably certain about the number, we should go ahead with that.

3 BOC signs a three-year $120 million contract, to hire Dakota Dokes as its new CEO, starting next month. No, there’s no obligation based on benefits that have been received currently or in the past which is the first criteria.

4 BOC has not yet paid employees who earned salaries of $1 million during the most recent pay period. Yes, salaries payable.

5 BOC is sued by a group of customers who claim their products were defective. The suit claims damages of $6 million. No, amount is not certain.

Stockholders’ Equity

Stockholders equity is the residual claim on assets after settling claims of creditors.

It’s also called, shareholders’ equity, owners’ equity, net worth, net assets, net book value.

Sources:

1 Contributed Capital(arise from sale of shares)

common stock(for par value)

Additional paid-in-capital(excess over par value)

Treasury Stock(stock repurchased by the company)

2 Retained Earnings(arise from operations)

Accumulation of net income(revenues - expenses),less dividends,since start of business

dividends

Dividends are distributions of retained earnings to shareholders

Not an expense, because dividends are not considered an expense because they’re not considered a cost of generating revenue. Instead dividends are a discretionary decision by the board of directors to return some funds back to shareholders that’s presumably somewhat independent of the company’s performance or sales during the period.

Recorded as a reduction of retained earnings on the declaration date (creates a liability until payment date).once the board declares a dividend, it’s essentially holding the shareholders’ money until it sends the check, making the shareholders “creditors” of the company.

Debit and Credit Bookkeeping

Part I

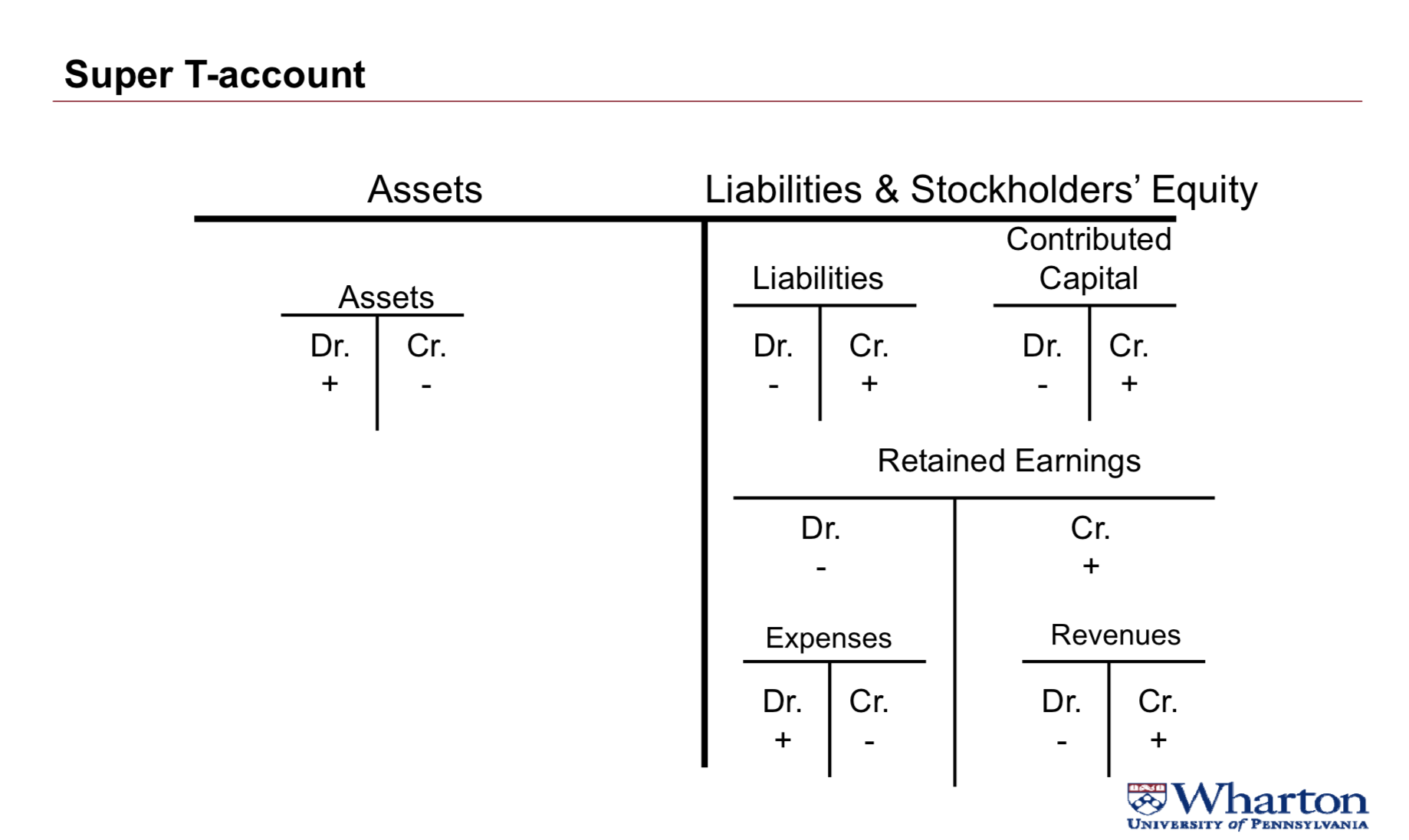

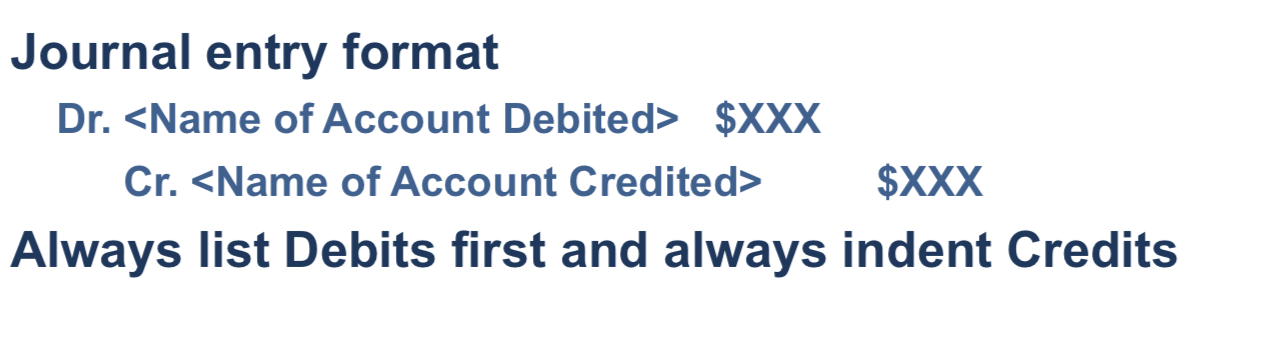

3 Bookkeeping fundemetal equations

A=L+E

Sum of debits = sum of credits then we know balanced sheet equation is preserved

– Debit (Dr.) = Left-side Entry

– Credit (Cr.) = Right-side Entry

Beginning account balance + Increases - Decreases = Ending account balance

Equation:

Assets+Expenses=Liabilities+Contri. Capital+Retained Earnings+Rev

A and Expenses:Dr.

Things on the right: Cr.

Rules of debits and credits

1 every transaction must have at least one debit and at least one credit

2 Debits must equal credits for all transactions.

3 No negative numbers are allowed. So you’re going to debit a positive number or credit a positive number.

Accounting Balance:

The difference between the sum of the debits and the sum of the credits

Change in Account Banlance Equation:

Begining Balance+Increases-Decreases=Ending Balance

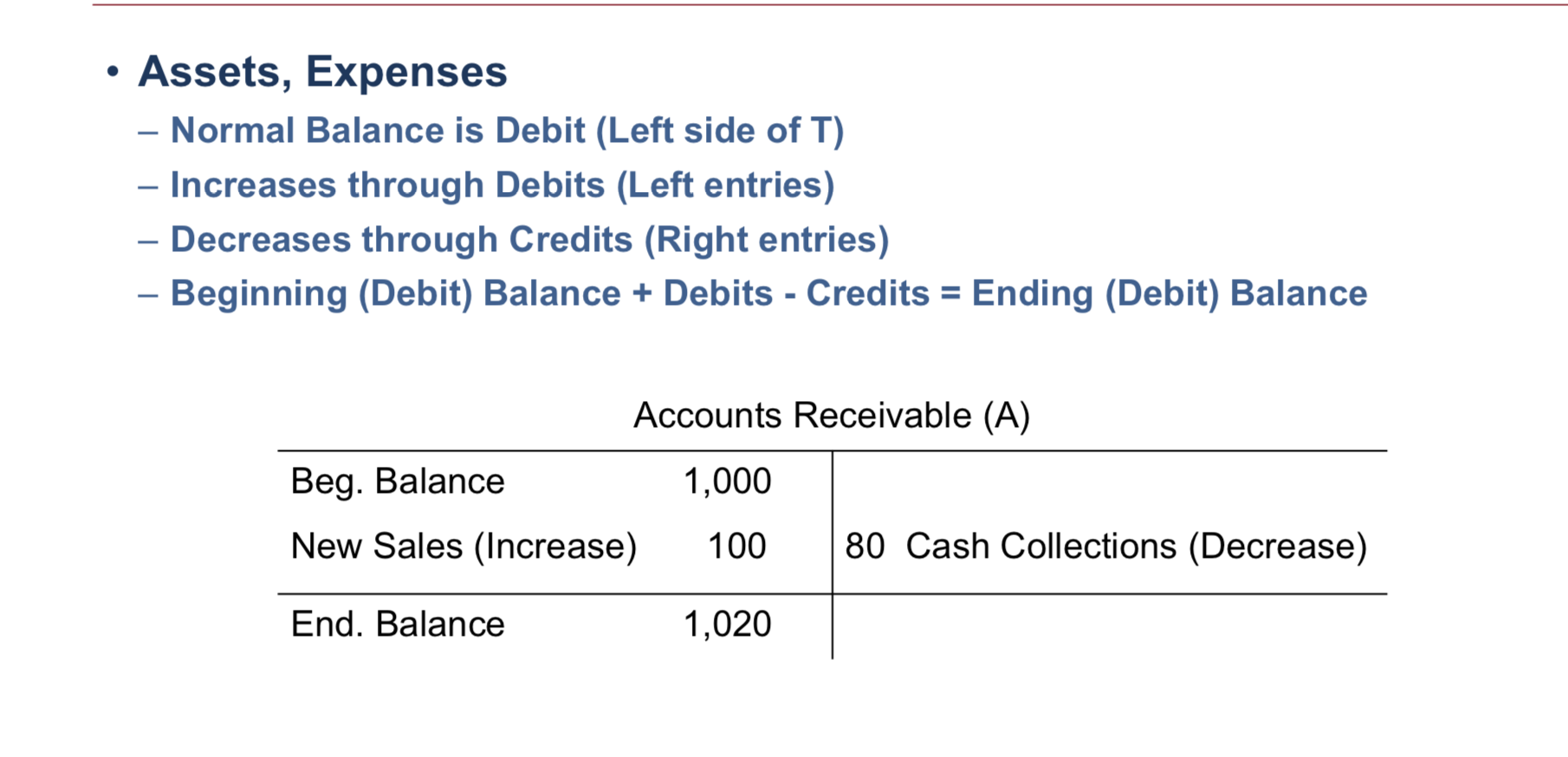

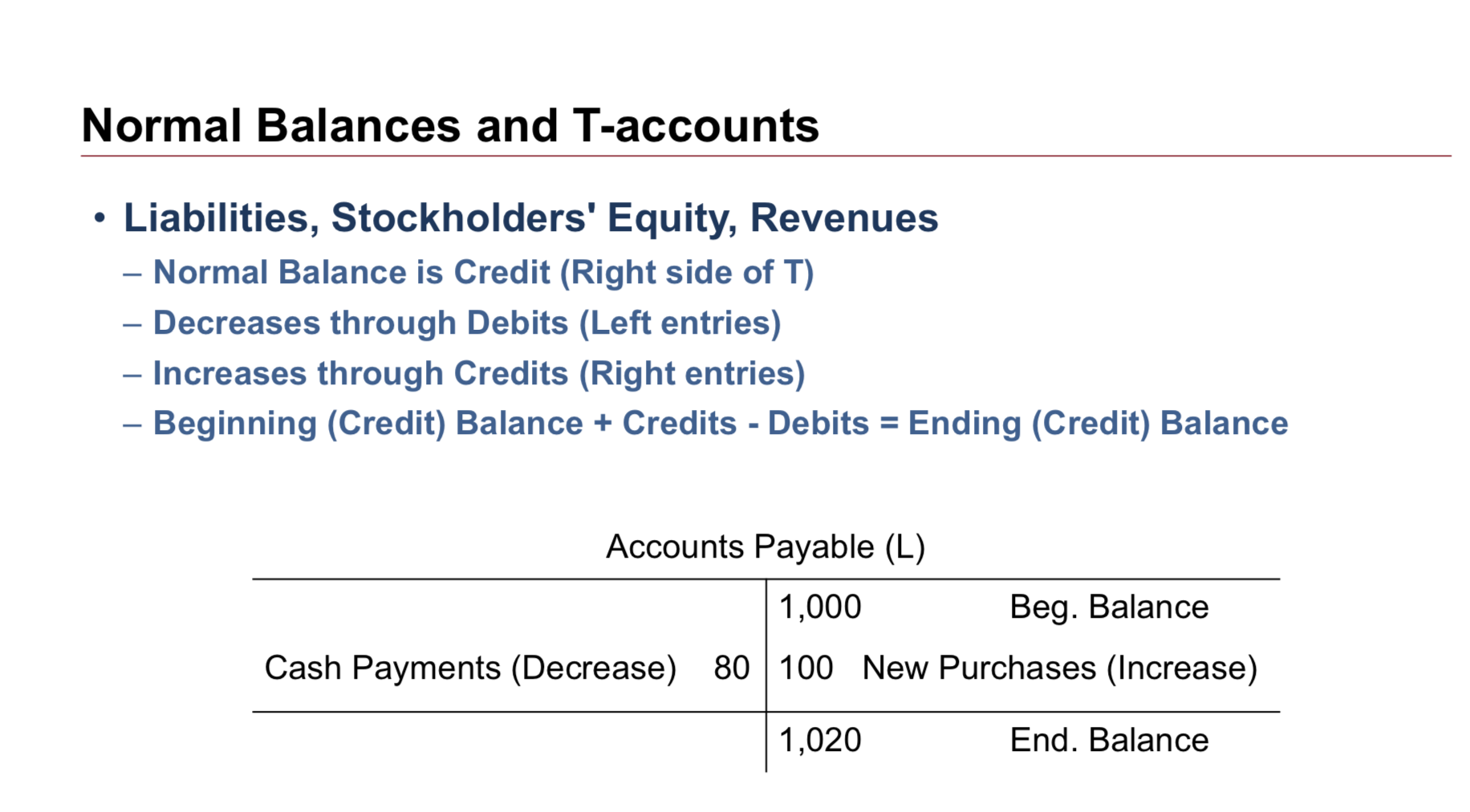

Normal Balances and T accounts

Beginning (Debit) Balance + Debits - Credits = Ending (Debit) Balance

Beginning (Credit) Balance + Credits - Debits = Ending (Credit) Balance

Debits increase a debit balance account and decrease a credit balance account. Credits increase a credit balance account and decrease a debit balance account.

super T account

Journal entry format

Part II

EXAMPLE:

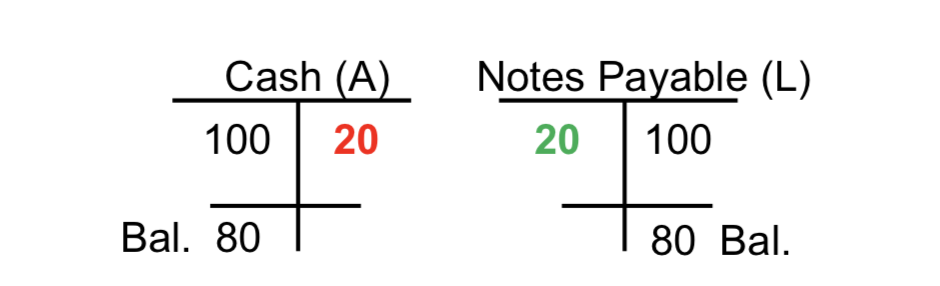

Decrease an asset and decrease a liability or equity – Repay $20 of a bank loan

• Balance Sheet Equation

Assets = Liabilities + Equity

(20) = (20) + 0

• Journal Entry

Dr. Notes Payable (-L) 20 because we decrease a credit account with debits; -L means reducing liabilities

Cr. Cash (-A) 20 we decrease a debit account with credits; -A means reducing assets

• T - accounts

Journal Entry Example

1 BOC issues 10,000 shares of \$5 par value stock for $15 cash per share

Dr. Cash (+A) 150,000

Cr. Common Stock–Par (+SE) 50,000

Cr. Additional Paid in Capital (+SE) 100,000

2 BOC acquires a building costing \$500,000. It pays \$80,000 cash and assumes a long-term mortgage for the balance of the purchase price

Dr. Buildings (+A) 500,000

Cr. Cash (-A) 80,000

Cr. Mortgage Payable (+L) 420,000

3 BOC retires \$1,000,000 of debt by issuing 100,000 shares of \$5 par value stock

Dr. Notes Payable (-L) 1,000,000

Cr. Common Stock–Par (+SE) 500,000

Cr. Additional Paid in Capital (+SE) 500,000

4 BOC receives an order for \$6,000 of merchandise to be shipped next month. The customer pays \$600 at the time of placing the order

Dr. Cash (+A) 600

Cr. Advances from Customers (+L) 600

We only account for the \$600, because that’s the only part where there’s been a transaction or exchange, because we received \$600 cash. For the other \$5,400, that’s all future stuff. That’s all promises. We don’t have a liability yet because there’s no obligation that’s based on benefits or services that we’ve received. Not until we exchange cash good or services equal to \$5,400 in the future. Will we have to record that part of the transaction?

5 BOC declares and pays \$8,000 of cash dividends

Dr. Retained Earnings (-SE) 8,000

Cr. Cash (-A) 8,000

The other part of the transaction is dividends. We’re paying dividends. Now remember, dividends are a reduction in retained earnings. Retained earnings are a stockholder equity account, stockholders equity accounts have credit balances; so we reduces them with debit.

Relic Spotter Case

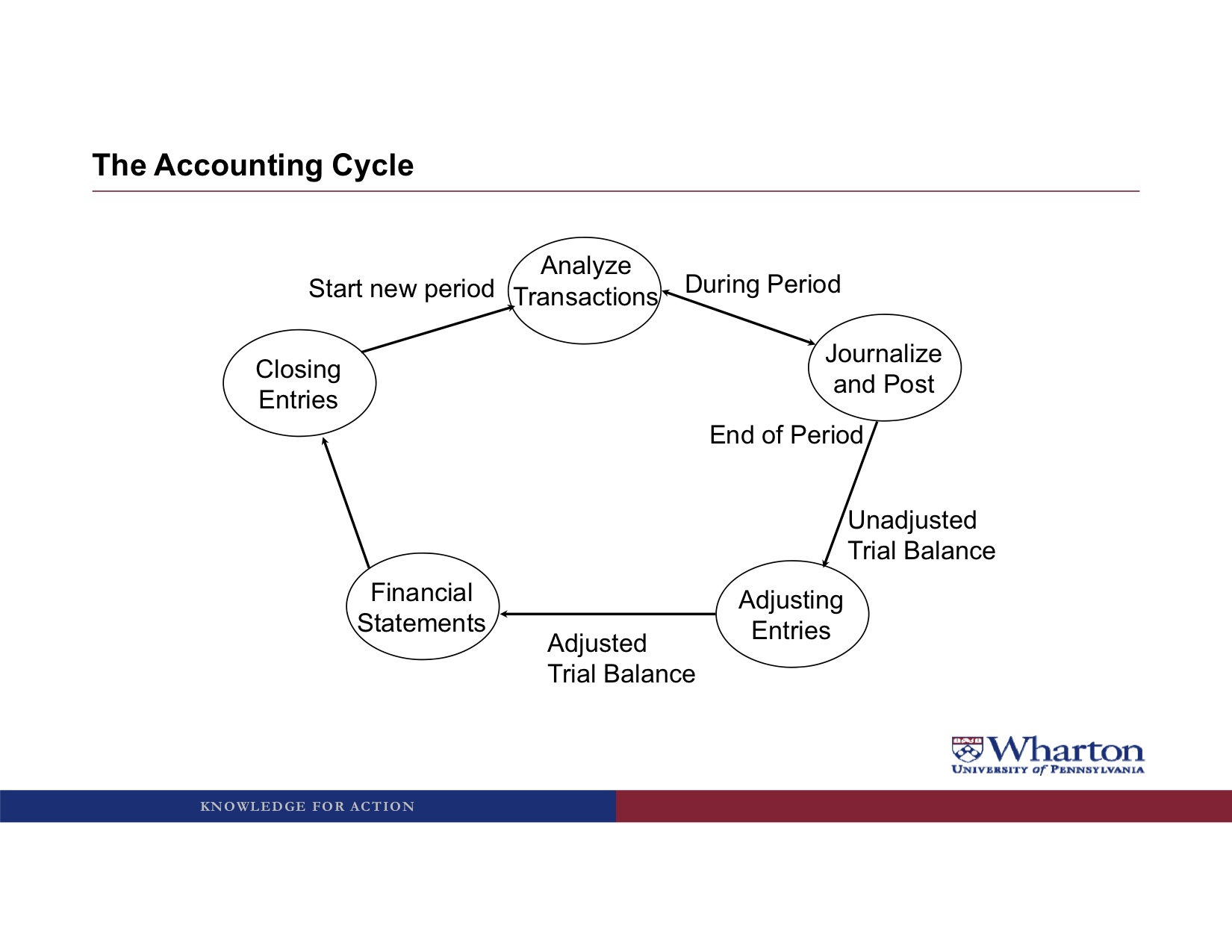

The accounting cycle

Case:

• (1) On April 1, 2012, Girard decided to invest \$200,000 and Park put up \$50,000 to purchase a total of 25,000 shares in the new company. The par value of the shares was $1.00

Dr. Cash (+A) 250,000

Cr. Common Stock (+SE) 25,000

Cr. Additional Paid-in-capital (+SE) 225,000

• (2) Lacking the funds for her initial investment, Park borrowed the \$50,000 from the Imperial Bank of Philadelphia on April 1, using her parent’s house as collateral

Park’s loan of \$50,000 not recorded by Relic Spotter

because it is a loan to Park personally, not to the business

entity concept: the only thing that should go in a company’s books are transactions for the company, not transactions for the employees.

• (3) On April 2, Park hired a lawyer to have the business incorporated. Because this was a fairly simple organization, the legal fees were only \$3,900

Dr. Legal Fee Expense (+E, -SE) 3,900

Cr. Cash (-A) 3,900

*increase expanse, reduce shareholder equity;

• (5) Park felt that some renovation work would extend the life of the building to 25 years (with an expected salvage value of \$10,000). She ordered the renovation work, costing \$33,000, to begin immediately. The work was completed on May 25, at which time she paid in cash the amount owed for the renovations

Dr. Building (+A) 33,000

Cr. Cash (-A)33,000 33,000

ignore the stuff about salvage value and 25 years. Instead, we’re gonna focus on the transaction that happened on May 25th, which is when Park paid the cash.

We only use the inventory account for goods that we buy with the intention of selling as quickly as possible at a markup. We don’t call the metal detectors inventory because we intend to keep them for two years and use them over and over and over and over again to generate rental revenues

One of the trickier things to pick up in accounting is, when you spend money, do you recognize an asset or do you recognize an expense? In this case, we did an asset, because we’re going to get three years of future benefits from buying the software.

• (9) On June 30, Park signed a contract with a local advertising agency to provide various forms of advertising for a period of one year. She paid $8,000 upfront for advertising through June 30, 2013

Dr. Prepaid Advertising (+A) 8,000

Cr. Cash (-A) 8,000

Well, we’re getting a year’s worth of advertising without having to pay any additional cash, that’s an asset. So we’re going to create an asset called prepaid advertising

• (10) On June 30, Park needed cash to make a payment on the Imperial Bank loan that funded her purchase of Relic Spotter stock. She borrowed $5,000 from Relic Spotter at 10% interest, with the principal and interest due in a lump sum on June 30, 2013

Dr. Notes Receivable (+A) 5,000

Cr. Cash (-A) 5,000

We credit cash for 5,000. So, what is Relic Spotter getting for this cash? What’s the debit? Well, essentially they’re making a loan. That loan is going to be an asset because they’re entitled to receive 5,000 of cash back from Rebecca Park at some point in the future.

Note that we call it notes receivable. And not accounts receivable. Accounts receivable is only used for customers, when customers owe us money.

• (12) On June 30, Girard called from St. Tropez to check in on the business. Upon hearing that Relic Spotter only had $47,000 of cash left in the bank, Girard became concerned about his investment. Thinking fast, Park stated that she was so confident of Relic Spotter’s prospects that she was declaring a $0.10 per share dividend, to be paid on August 31 ($2,500). This dividend seemed to reassure Girard

Dr. Retained Earnings (-SE) 2,500

Cr. Dividends Payable (+L) 2,500

By convention, when a company declares a dividend it takes it out of retained earnings at that point, even if the cash is going to be paid later. And at that point, the owners become creditors because the company is holding their cash until the dividend checks are sent.

To make sure that the balance sheet equation always stays in balance, we need at least one account that can be either a debit or credit balance.Imagine if we had more liabilities then assets. The only way we could get the balance sheet equation to balance would be with negative stockholders’ equity. And so we make an exception for retained earnings and allow it to have either a debit or credit balance because it’s the one account that makes sure that the balance sheet equation always stays in balance.

3M case study

take care of part II, here’s the big thing management discussion analysis. This is where management tries to explain to the users of the financial statements, what happened during the year. So all the numbers that changed, went up, went down or didn’t change. Tries to provide some kind of explanation so that users can understand the financial statements.

look at the financial statements and the footnotes first. Come up with my own theories for what happened. And then come and see what management’s saying about it. Just as a reality check of whether I can believe what they’re saying.

the financial statements are probably not going to have all the information we need. We’re going to have to dive into these footnotes to really learn what we need to learn about the company. And we’re going to be doing a lot as we go through the course, is looking at the details of the footnotes. because that’s where all the action is.